Hey Fam,

You’ve reached Field Research, a twice monthly newsletter featuring informative and entertaining takes at the intersection of art, business, and culture.

I’m your host, Amran Gowani, a mad scientist turned corporate mercenary turned totally well-adjusted author. My debut novel Leverage is a propulsive, darkly hilarious Wall Street thriller and will be published by Atria Books, an imprint of Simon & Schuster, in Summer 2025.

In today’s issue I review Viet Thanh Nguyen’s The Sympathizer and Alex Gar—

Alright, alright. I won’t skirt over the fact I completely demolished and rebuilt this newsletter without warning.

After two-and-a-half years as a “humor and satire” publication, Field Research is evolving. Version 2.0 will feature critical analysis, content curation, and comedic takes on the wide worlds of business and entertainment.

I could waste hundreds of words explaining why I’m switching things up, but that would be very inside baseball, and not very interesting. Better to just show you loyal readers the new format and approach, which I’m confident you’ll love.

Rest assured: nothing can change the fact I’m a deeply unwell person with a deeply deranged sense of humor, which means you can expect my patented blend of mordant wit and macabre mirth to continue unabated.

So, as I was saying, in today’s issue I review Viet Thanh Nguyen’s The Sympathizer and Alex Garland’s Civil War, define the term “balance sheet,” and share information about an exciting new career opportunity: buttling1 for the grotesquely rich.

Enjoy the show.

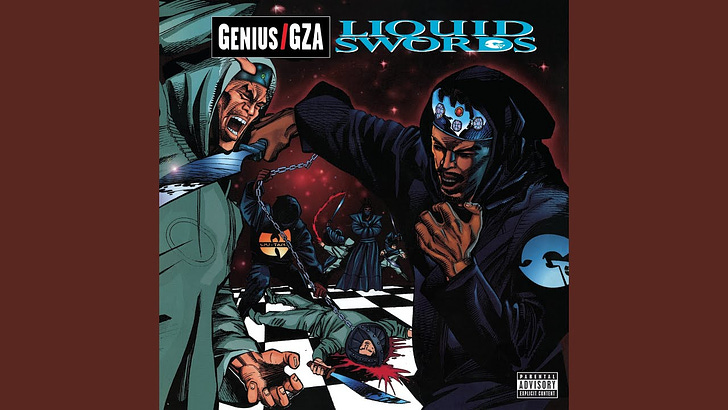

I. TRACK OF THE DAY

II. GET SMARTER

I peruse The Economist, The Financial Times, and other online rags for my amusement and your benefit. Here are five things worth knowing.

Disrupted disruptors: Exorbitant costs and nonsense valuations mean the VC funds of yesteryear are getting shut out of the “AI” arms race. Tech behemoths (e.g., Microsoft) and sovereign wealth funds are bridging the gap, which is actually great news. When the bubble invariably bursts, scores of techno-libertarian shitheels will lose billions of dollars.

Involuntary M&A celibacy: Economic nationalism, combative regulators, and hostile investors have dampened the empire-building proclivities of once covetous CEOs. Without financial engineering to fall back upon, what are these champions of industry supposed to do? Compete?

Efficient ain’t accurate: This FT interview with Eugene Fama, the Nobel Prize-winning economist who posited the “Efficient Market Hypothesis,” provides an overview of the theory and explains how it’s often misinterpreted or misunderstood. Namely, market prices are “efficient” because they incorporate all available information and represent the “wisdom of the crowd.” Of course, crowds are often full of shit, as evidenced by the financial panics, shocks, and crashes of 1901, 1907, 1914, 1929, 1937, 1973, 1987, 2001, 2007, and 2020.

Convergence of crap: YouTube looks increasingly like old school television, with creators employing big budgets, professional staffs, and fancy kit to produce comedies, dramas, and sports. Mega streamers such as Disney and Netflix are going mobile and jamming every available screen with intrusive ads. The upshot of these blurring business models? Your fallout shelter will never run out of shitty “content.”

An exciting career opportunity: The International Butler Academy (TIBA) cordially invites interested parties to apply to their intensive, ten-week training program, which will prepare you to serve as an errand boy — or girl — for humanity’s most despicable people. Responsibilities include, but are not limited to, cooking, chauffeuring, ordering escorts, trafficking narcotics, sanitizing sex dungeons, ordering exotic animals, procuring tickets to Taylor Swift concerts and Premier League matches, and managing Google calendars. Thick skin and discretion required. Annual salaries up to $200,000. Learn more at 1843 Magazine.

III. READ: THE SYMPATHIZER

The Sympathizer, Viet Thanh Nguyen’s blistering debut novel, which won the 2016 Pulitzer Prize, lives up to the considerable hype.

The story follows an unnamed narrator during the end of the Vietnam War who’s stuck between two worlds and belongs to neither. He’s a North Vietnamese spy embedded in the South Vietnamese army. He’s of mixed-race heritage — half French and half Vietnamese — and is viewed with suspicion by #purebloods on #bothsides. He’s an ardent communist with a soft spot for capitalism. All these tensions and contradictions are captured in the novel’s killer opening line: “I am a spy, a sleeper, a spook, a man of two faces.”

What I loved: The deep first-person narration is incredibly fun and darkly funny, and our conflicted hero tosses out one-liners, macro-aggressions, and sharp cultural observations with aplomb. Despite a literary bent, there’s plenty of plot, too, which drives the action from the fall of Saigon to a Vietnamese immigrant community in Los Angeles to an unhinged film set in the Philippines.

What I didn’t: It’s clear on page one our nameless narrator is writing a sort of confession to his mysterious “Commandant.” As the book reaches its climax, however, that narrative structure collapses, and Nguyen plays with form and point-of-view in unusual and unexpected ways. I appreciated his ambition and panache but would’ve preferred to see the novel stay consistent through the ending. Of course, that’s just, like, my opinion, man, and your mileage may vary.

Final verdict: Misgivings about the finale aside, I immensely enjoyed this book and strongly recommend checking it out. The Committed, a sequel published in 2021, is sitting on my bookshelf, patiently waiting for my ungrateful children and decaying condo to cooperate with my literary lifestyle.

Related media: The Sympathizer was adapted into a limited series on HBO Max (or whatever it’s called) earlier this year. I watched the first and fourth episodes and I’m sad, but not surprised, to say the film version is a poor facsimile of the novel. Read the book, skip the show.

IV. A POEM ABOUT: FALL

Title: Pumpkin-spiced senescence

Flowers lose

their will

to live.

Pathogens stir

inside

your office

and children.

Princeton colors

assault

your senses, and

decency.

Darkness smothers

the afternoon

sky. Death

consumes all.V. JARGON JUNCTION: BALANCE SHEET

In this section I decipher the rampant doublespeak endemic throughout Corporate America and Wall Street. This helps you spot bullshit in the real world, and better prepares you to read my kickass novel Leverage.

A balance sheet is an important financial statement which lists a company’s assets, liabilities, and equity. I realize I just defined jargon with more jargon, which is not very insightful. Let’s dig in further.

An asset is something a company owns, which has “market value” and can be exchanged or converted into cash2. Assets on a company’s balance sheet include cash (obv), stocks, bonds, vehicles, heavy machinery, office buildings, manufacturing plants, land, etc.

A liability is something a business owes, which needs to be paid out or paid back. Liabilities include short-term loans and long-term debt, bills for goods, services, and utilities, employee bonuses, salaries, and pensions, deferred taxes, etc.

Equity is the difference between total assets and total liabilities, and reflects the “value” accrued to and owned by shareholders.

A balance sheet balances because the total assets are equal to the total liabilities plus the total equity, i.e., Assets = Liabilities + Equity.

Here’s another way to think about this relationship: if a company liquidated all of its assets, and settled all of its liabilities, the difference would be the equity owned by investors.

Seems straightforward, right?

It is, except there’s one major problem with a balance sheet: it only captures a single snapshot in time, and that snapshot is only published once per quarter. (There are several other issues, which I’ll skip for now.)

Let’s consider a very simple balance sheet.

Imagine you want to buy a $500,000 house, and you’ve saved $100,000 in cash for the down payment. Before you make this terrible decision, your balance sheet has $100,000 in assets (your cash), $0 in liabilities (you don’t owe nobody nothing), and $100,000 in equity (your cash).

Suppose you finalize this terrible decision on September 30 and file your balance sheet with the Securities and Exchange Commission. You report $500,000 in assets (the market value of your house), $400,000 in liabilities (your mortgage, or the portion of your house the bank “owns”), and $100,000 in equity (the portion of your house you “own”).

Assume the very next day, October 1, the housing market crashes and the value of your house plummets to $300,000.

What does your real-time balance sheet look like?

You have $300,000 in assets (the market value of your house), $400,000 in liabilities (the bank doesn’t give a shit about your problems), and negative $100,000 in equity (you’ve officially become less than worthless).

Of course, since you prepared and filed your documentation the day before, on paper everything still looks great.

What’s the takeaway?

Never buy a house.

Also, when you look at a balance sheet, remember it’s a static document and only reflects the business and market conditions on the day it was prepared.

Big multinational corporations are orders of magnitude more complex than the example I provided above, which means a once per quarter gander at their “consolidated” balance sheets may not represent reality.

Worse yet — and something we’ll get into in future issues — is every single accounting metric on a balance sheet is ripe for deception, manipulation, and fraud. This introduces additional layers of complexity into even the most rigorous financial analysis.

From the vault: I did a deep dive explaining “How to value an asset” last summer, which is educational and fun.

VI. WATCH: CIVIL WAR

Civil War is a much discussed and mildly controversial film written and directed by Alex Garland and produced by A24 Studios. The cast is headlined by Kirsten Dunst and features a host of excellent co-stars, including Nick Offerman, Jesse Plemons, and Wagner Moura.

The film imagines a dystopian, near-future version of the United States which has devolved into the titular conflict between the so-called “Western Forces” of California and Texas and an extremist federal government. Viewers follow a group of war journalists en route to Washington D.C. as they navigate brutality, chaos, and wanton violence in the hopes of documenting the imminent collapse of the once-proud republic.

What I loved: Excellent performances, brilliant set pieces, beautiful cinematography, harrowing imagery, and clever editing — Alex Garland knows how to make a goddamned movie, which is why studios keep throwing money at him. Civil War is visceral and visually arresting.

What I hated: The writing — in particular the world-building — in this film is, as my friend Martin might say, irresponsible. I have dozens of qualms and frustrations to choose from, so I’ll highlight two of the most egregious.

First, I’m asked to believe this is a near-future version of America, but no probable explanation is offered as to why California and Texas would “team up” to overthrow the federal government.

This the laziest possible way to “de-politicize” the idea of individual states fighting back against federal overreach. If California were to attempt secession it would almost certainly go solo, relying on its status as the fifth largest standalone economy in the world to create its own currency, trade pacts, armed forces, etc. In doing so, it would also immediately get invaded by the U.S. military and re-annexed.

Second, this movie casually dismisses macroeconomics and instead aims its lens at the “conditions on the ground.” Problem is, because of this choice, the conditions on the ground aren’t remotely believable. For example, early in the film there’s a scene where the journalists need to buy gasoline and end up haggling with the “overseer” of the station. Dunst’s character offers three hundred “dollars” (assumed to be U.S.) for a tank and two refills and is laughed off. She then says “Canadian,” which shocks the attendant, and he quickly accepts.

What’s the problem, you ask?

Well, how exactly would the Canadian Dollar fare if the U.S. — by far its biggest trading partner — collapsed? And how would the rest of the world fare if the good ole greenback, our planet’s de facto reserve currency, went into an inflationary death spiral? The answers are: not well. In our highly interconnected system the macroeconomic and geopolitical dominoes would’ve fallen fast and fallen hard. America’s implosion would’ve cratered currencies and markets worldwide and hosed every single country holding huge amounts of its debt, including Japan, China, the U.K., many Western European countries, and, of course, Canada.

Final verdict: This movie is a mess — at once expertly made and utterly unserious — and yet, it’s worth a look. At just under two hours it sports an efficiency and elegance uncommon in modern films and, if nothing else, doesn’t demand too much of your time.

Where to watch: HBO Max (or whatever it’s called).

VII. SOMETHING: UNEXPECTED

Last month I participated on a panel with several literary power brokers — including

, , , and — where we discussed the state of the publishing industry and some of the key challenges facing modern authors.The insightful conversation was transcribed and published on Jane’s professional newsletter, The Hot Sheet, on Wednesday. You can read the entire discussion for free by clicking HERE.

VIII. UP NEXT

The new and possibly improved Field Research will publish every other Friday for the remainder of the year. We’ll catch up again on October 11.

I hope you enjoyed the revised format and plan to stick around for this exciting new phase. I’m always receptive to suggestions and feedback. Also, if there’s a news story, novel, or movie you think I should check out, let me know. Leave a comment or reply to this email.

Finally, if you would be so kind, here are some quick, free, and helpful ways you can support my career as an author:

Forward this post to friends and family and encourage them to sign up

Share this post on your favorite social media platform

“Like” this post and/or “Re-stack” in Substack Notes

Thanks always for your support and engagement.

Stay frosty out there.

Amran

The act of working as a butler is “to buttle.”

For the millionth goddamned time: cash rules everything around us.

Loved the new Vol 2 format! Read and enjoyed every single section and sub-section and was surprised by how fun the Jargon section was. Bravo!

Excited to see the new format! Felt the same way about The Sympathizer. Loved the book, but then he sorta lost me toward the end. The show was meh. Sorta proves the main character’s thesis that Hollywood can’t do a good Vietnam war story.